Market Study

Related Services

Featured Services

Need Help ?

- 5 PORTSAID SQUARE, MAADI CAIRO - EGYPT

- 16ERA

- info@era-egypt.com

Request a Free Call from ERA Expert

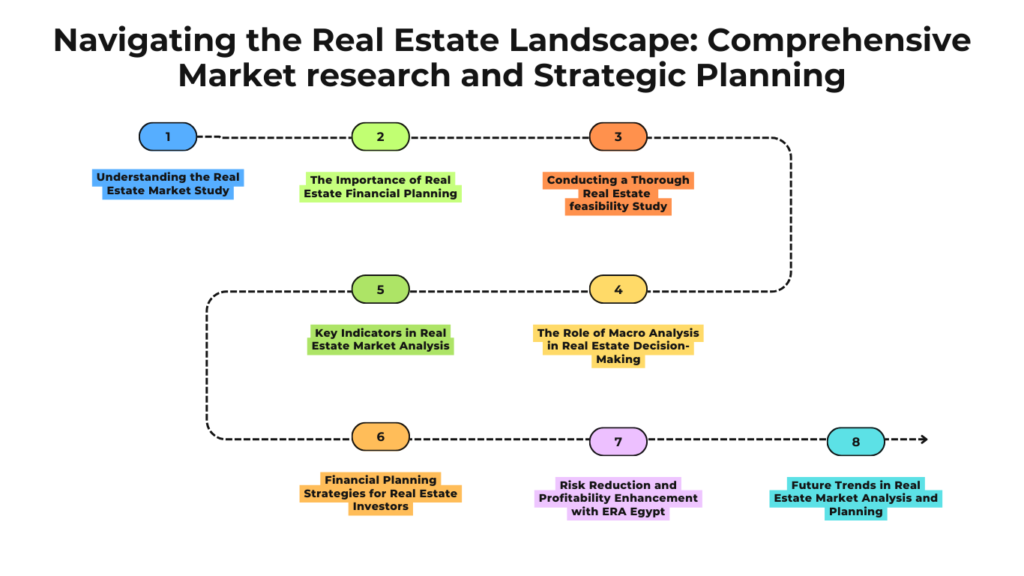

Navigating the Real Estate Landscape: Comprehensive Market research and Strategic Planning

Navigating the real estate landscape requires a nuanced understanding of various factors that influence market dynamics and investment decisions. From conducting comprehensive market studies to strategic financial planning, and from enhancing property feasibility to leveraging advanced technologies, each aspect plays a crucial role in achieving success in this competitive field. This post delves into essential topics such as the importance of real estate financial planning, conducting thorough feasibility studies, the role of macro analysis, and future trends in market analysis and planning. By exploring these insights, investors and stakeholders can make informed decisions that align with market realities and optimize their returns.

Understanding the Real Estate Market Study: A Foundation for Success

Understanding the real estate market is crucial for anyone looking to succeed in property investment, development, or sales. A comprehensive market study provides the essential insights needed to make informed decisions, minimize risks, and maximize returns.

At its core, a real estate market study involves analyzing various factors that influence property values and demand. This includes economic indicators like employment rates, income levels, and population growth. By examining these factors, investors can gauge the overall health of a market and predict future trends.

One key aspect of a market study is the supply and demand analysis. This involves assessing the number of available properties versus the number of potential buyers or tenants. An imbalance between supply and demand can significantly affect property prices and rental rates. For instance, an oversupply of properties may lead to lower prices, while high demand with limited supply can drive prices up.

Another critical component is understanding the local market dynamics. Each real estate market has unique characteristics influenced by regional economic conditions, cultural factors, and government policies. A thorough study will delve into these specifics, providing a nuanced view that generic national data cannot offer.

Additionally, competitive analysis is vital. Knowing who your competitors are and what they offer can help identify gaps in the market and potential opportunities. This includes analyzing their pricing strategies, property features, and marketing tactics.

Moreover, demographic trends play a significant role in shaping real estate markets. Factors such as age distribution, family size, and migration patterns can influence housing needs and preferences. Understanding these trends helps in tailoring properties to meet market demands effectively.

In conclusion, a well-conducted real estate market study lays the foundation for success by offering deep insights into economic indicators, supply and demand dynamics, local market characteristics, competitive landscape, and demographic trends. These insights empower stakeholders to make strategic decisions that align with market realities, thereby enhancing their chances of achieving desired outcomes in the real estate sector.

The Importance of Real Estate Financial Planning

Real estate financial planning is a critical component for anyone looking to navigate the complex landscape of property investment. Whether you are a first-time homebuyer, a seasoned investor, or someone looking to diversify their portfolio, understanding the financial intricacies can make or break your success in the market.

Firstly, real estate financial planning helps you establish a clear budget. Knowing how much you can afford to spend on a property, including hidden costs such as taxes, insurance, maintenance, and potential renovations, ensures that you do not overextend yourself financially. A well-defined budget acts as a safeguard against unforeseen financial strain and allows for more strategic decision-making.

Secondly, having a solid financial plan enables you to leverage various financing options effectively. Mortgages, loans, and other financing tools come with different terms and conditions. By understanding these intricacies, you can select the best financing option that aligns with your long-term goals and current financial standing. This strategic approach not only minimizes risks but also maximizes returns on investment.

Moreover, real estate financial planning allows for better risk management. The property market is subject to fluctuations due to economic conditions, interest rates, and other external factors. A comprehensive financial plan includes contingency measures such as emergency funds and insurance coverage that protect your investments from potential downturns.

Additionally, tax considerations are an integral part of real estate financial planning. Understanding how property taxes, capital gains taxes, and other levies impact your investments can save you significant amounts of money in the long run. Strategic tax planning can enhance your overall profitability by optimizing tax benefits available to property investors.

In summary, real estate financial planning is indispensable for achieving sustained success in the property market. It provides a structured framework that guides your investment decisions, mitigates risks, and enhances financial stability. By prioritizing this aspect of real estate investment, you position yourself for long-term growth and profitability in an ever-evolving market.

Conducting a Thorough Real Estate Feasibility Study

A thorough real estate feasibility study is pivotal in determining the potential success of a property in the market. This study involves a comprehensive analysis of various factors that influence a property’s feasibility and attractiveness to potential buyers or tenants. The primary goal is to assess how well a property can be seen, accessed, and evaluated by its target audience.

To begin with, location analysis is critical. This involves evaluating the property’s proximity to essential amenities such as schools, hospitals, shopping centers, and public transportation. A well-located property is more likely to attract interest and command higher value. Additionally, understanding the demographic profile of the area helps tailor marketing strategies to appeal to the right audience.

Next, the physical condition and curb appeal of the property play a significant role in feasibility. Properties that are well-maintained and aesthetically pleasing are more likely to catch the eye of potential buyers or renters. This includes landscaping, exterior paint, and overall upkeep. A property that makes a good first impression can significantly enhance its marketability.

Digital feasibility is another crucial aspect of the study. In today’s digital age, most property searches begin online. Ensuring that the property has a strong online presence through high-quality photos, virtual tours, and detailed descriptions can greatly increase its feasibility. Leveraging social media platforms and real estate listing websites is essential for reaching a broader audience.

Moreover, competitive analysis should not be overlooked. Understanding what similar properties in the area offer in terms of price, features, and incentives can help position your property more effectively. This includes analyzing current market trends and identifying gaps that your property can fill.

In conclusion, conducting a thorough real estate feasibility study requires meticulous attention to various factors that influence how a property is perceived by its target audience. By focusing on location, physical condition, digital presence, and competitive landscape, you can strategically enhance your property’s feasibility and market success.

ERA Egypt: Pioneers in Real Estate Market Feasibility Planning

ERA Egypt has established itself as a trailblazer in the domain of real estate market feasibility planning. With a profound understanding of the intricacies involved in real estate, ERA Egypt offers unparalleled expertise and insights that set them apart in this competitive field. Their approach is rooted in a comprehensive methodology that combines data-driven analysis with a deep understanding of market dynamics.

One of the core strengths of ERA Egypt lies in their ability to meticulously assess market conditions and identify emerging trends. They utilize advanced analytical tools and techniques to gather and interpret data, providing clients with actionable insights that inform strategic decisions. This rigorous approach ensures that their clients are always one step ahead, able to capitalize on opportunities and mitigate risks effectively.

ERA Egypt’s commitment to excellence is reflected in their personalized service. Recognizing that each client has unique needs and objectives, they tailor their strategies to align with specific goals. This bespoke approach not only enhances market feasibility but also maximizes return on investment, making ERA Egypt a trusted partner for investors, developers, and other stakeholders in the real estate sector.

Furthermore, ERA Egypt places a strong emphasis on transparency and ethical practices. They believe that trust is the cornerstone of successful business relationships, and they strive to build long-term partnerships based on integrity and mutual respect. By providing clear, honest communication and delivering results that consistently meet or exceed expectations, ERA Egypt has earned a reputation for reliability and professionalism.

In an ever-evolving real estate landscape, ERA Egypt remains at the forefront by continuously innovating and adapting to new challenges. Their dedication to staying ahead of industry trends and technological advancements ensures that they remain leaders in market feasibility planning, helping their clients navigate the complexities of the real estate market with confidence and precision.

The Role of Macro Analysis in Real Estate Decision-Making

Macro analysis plays a crucial role in the real estate decision-making process by providing a broad view of economic, social, and political factors that can influence market dynamics. This type of analysis helps investors and developers understand the external environment in which they operate, ensuring that their decisions are well-informed and strategically sound.

At its core, macro analysis examines key economic indicators such as GDP growth, unemployment rates, inflation, and interest rates. These metrics offer insights into the overall health of an economy and its potential impact on the real estate market. For example, high GDP growth typically signals a robust economy with increased demand for both residential and commercial properties. Conversely, high unemployment rates may indicate a sluggish economy, potentially leading to lower property values and reduced rental income.

In addition to economic factors, macro analysis also considers demographic trends. Population growth, age distribution, and migration patterns can significantly affect real estate demand. For instance, an area experiencing rapid population growth may present lucrative opportunities for residential development, while regions with an aging population might see increased demand for retirement communities and healthcare facilities.

Political stability and government policies are another critical component of macro analysis. Regulatory changes, tax policies, and incentives can either enhance or hinder real estate investment prospects. Investors must stay abreast of legislative developments to anticipate potential risks and opportunities. For example, favorable tax incentives for first-time homebuyers can stimulate demand in the housing market.

Social factors such as lifestyle changes and consumer preferences also play a role in shaping real estate markets. The rise of remote work has increased demand for suburban homes with dedicated office spaces, while urban areas may see a decline in office space occupancy rates.

In conclusion, macro analysis provides a comprehensive understanding of the broader forces at play in the real estate market. By integrating this analysis into their decision-making process, investors and developers can make more informed choices, mitigate risks, and capitalize on emerging opportunities.

Key Indicators in Real Estate Market Analysis

Understanding key indicators in real estate market analysis is essential for making informed investment decisions. These indicators provide valuable insights into market conditions, trends, and potential risks, thereby enabling investors to strategically plan their actions. Here are some of the most critical indicators to consider:

Supply and Demand Dynamics:

The balance between the number of properties available (supply) and the number of buyers or renters seeking properties (demand) is fundamental. A high demand with low supply typically leads to increased property prices, while an oversupply can result in price reductions and longer selling times.

Price Trends:

Monitoring historical and current price trends helps in identifying growth patterns or declines in specific areas. This includes average sale prices, rental rates, and price per square foot, which can signal the health of a market.

Economic Indicators:

Broader economic factors such as employment rates, income levels, and GDP growth impact real estate markets significantly. A robust economy usually translates to higher purchasing power and increased real estate investments.

Interest Rates:

Interest rates directly affect mortgage rates, influencing buyers’ ability to finance properties. Lower interest rates generally make borrowing more affordable, boosting demand for real estate.

Housing Starts and Building Permits:

These figures indicate future supply levels. An increase in housing starts and building permits suggests that more properties will enter the market, potentially affecting supply dynamics and pricing.

Vacancy Rates:

High vacancy rates can indicate an oversupply or lack of demand in a particular area, while low vacancy rates suggest strong demand and limited supply.

Foreclosure Rates:

High foreclosure rates can depress property values in an area and signal economic distress among homeowners.

Demographic Trends:

Population growth, migration patterns, age distribution, and household composition all influence housing demand and preferences.

By closely monitoring these key indicators, investors can gain a comprehensive understanding of market conditions, helping them to make strategic decisions that align with their investment goals and risk tolerance.

Financial Planning Strategies for Real Estate Investors

Effective financial planning is paramount for real estate investors aiming to maximize their returns and mitigate risks. One foundational strategy is setting clear investment goals. This involves defining whether the primary objective is capital appreciation, rental income, or a combination of both. Investors should establish short-term and long-term goals to guide their investment decisions.

Another critical strategy is budgeting accurately. Investors must account for all costs associated with purchasing and maintaining a property, including mortgage payments, property taxes, insurance, maintenance, and potential vacancy periods. Creating a comprehensive budget helps in understanding the financial commitment required and prevents unexpected financial strain.

Diversification is also essential in real estate investment. By spreading investments across different property types and locations, investors can reduce risk exposure. For example, investing in both residential and commercial properties in various geographic areas can safeguard against market fluctuations in a single sector or region.

Leveraging financing options effectively can enhance investment potential. Understanding the different types of mortgages and loan products available allows investors to select the best financing option that aligns with their investment strategy. Additionally, maintaining a good credit score can secure better interest rates and loan terms, thereby reducing overall borrowing costs.

Regularly reviewing and adjusting the investment portfolio is crucial for sustained success. Market conditions and personal financial situations change over time, necessitating periodic reassessment of investments to ensure they continue to align with set goals. This may involve selling underperforming properties or reinvesting profits into higher-yield opportunities.

Lastly, seeking professional advice from financial planners or real estate advisors can provide valuable insights and strategies tailored to individual circumstances. These professionals can offer guidance on tax implications, legal considerations, and optimal investment structures, ensuring informed decision-making.

By implementing these financial planning strategies, real estate investors can build a robust portfolio that delivers consistent returns while managing risks effectively.

Risk Reduction and Profitability Enhancement with ERA Egypt

In the dynamic landscape of real estate, mitigating risks and enhancing profitability are pivotal for sustained success. ERA Egypt stands as a beacon of reliability and expertise in this domain, leveraging its extensive experience and cutting-edge methodologies to ensure that clients achieve their financial goals while minimizing potential pitfalls.

One of the primary strategies ERA Egypt employs for risk reduction is thorough market analysis. By conducting comprehensive studies on market trends, economic indicators, and consumer behaviors, ERA Egypt provides clients with a clear understanding of the current and future state of the market. This proactive approach allows investors to make informed decisions, avoiding potential downturns and capitalizing on emerging opportunities.

ERA Egypt also places a significant emphasis on due diligence. This involves meticulous scrutiny of every aspect of a potential investment, from legal documentation to structural integrity. By ensuring that all properties meet stringent standards, ERA Egypt helps clients avoid unforeseen complications that could lead to financial losses or project delays.

Moreover, ERA Egypt offers tailored financial planning services. Understanding that each client has unique financial constraints and goals, ERA Egypt’s experts develop customized budget plans that align with individual needs. These plans include detailed cost estimations, loan options, and revenue projections, providing a comprehensive financial roadmap for each project. This level of precision not only enhances profitability but also instills confidence in investors by presenting a clear path to success.

Another critical component of ERA Egypt’s approach is risk diversification. By advising clients to spread their investments across various property types and locations, ERA Egypt reduces the overall risk exposure. This strategy ensures that even if one segment of the market experiences a downturn, the impact on the client’s portfolio remains manageable.

Additionally, ERA Egypt leverages advanced technological tools to enhance decision-making processes. Utilizing data analytics and predictive modeling, ERA Egypt can forecast market movements with greater accuracy. These insights allow clients to anticipate changes and adjust their strategies accordingly, ensuring they remain ahead of the curve.

ERA Egypt’s commitment to continuous improvement also plays a vital role in risk reduction and profitability enhancement. The company regularly updates its methodologies and stays abreast of industry advancements to provide clients with the most effective solutions. This dedication to excellence ensures that clients benefit from the latest innovations in real estate management.

In summary, through meticulous market analysis, rigorous due diligence, customized financial planning, risk diversification, and the use of advanced technological tools, ERA Egypt significantly reduces risks and enhances profitability for its clients. By partnering with ERA Egypt, investors can navigate the complexities of the real estate market with confidence, knowing they have a trusted ally dedicated to their success.

Future Trends in Real Estate Market Analysis and Planning

As the real estate landscape evolves, staying ahead of emerging trends is crucial for investors, developers, and planners. One significant trend shaping the future of real estate market analysis and planning is the integration of advanced technologies such as Artificial Intelligence (AI) and Big Data. These technologies are revolutionizing how market data is collected, analyzed, and interpreted, enabling more accurate predictions and strategic decision-making.

AI algorithms can process vast amounts of data from various sources, including social media, economic indicators, and consumer behavior patterns, to identify trends that may not be immediately apparent. This allows for more precise forecasting of market movements and property values, providing a competitive edge in a dynamic market.

Big Data analytics also play a pivotal role in enhancing market feasibility. By aggregating data from diverse sources such as public records, transactional data, and demographic information, Big Data tools can generate comprehensive market insights. These insights help stakeholders understand emerging patterns and shifts in demand, guiding investment strategies and development plans.

Sustainability is another critical trend influencing future real estate planning. With increasing awareness of environmental impact and regulatory pressures, there is a growing emphasis on sustainable development practices. This includes energy-efficient building designs, the use of renewable materials, and the incorporation of green spaces. Investors and developers who prioritize sustainability are likely to benefit from incentives and an enhanced reputation among environmentally conscious consumers.

Moreover, the rise of remote work has altered residential and commercial real estate dynamics. There is a noticeable shift towards properties that offer flexible workspaces and are located in suburban or rural areas, reflecting changing lifestyle preferences. Real estate planners must adapt to these changes by considering the demand for multi-functional spaces that accommodate both living and working needs.

In summary, future trends in real estate market analysis and planning are heavily influenced by technological advancements, sustainability considerations, and changing work patterns. Embracing these trends will be essential for navigating the complexities of the modern real estate landscape effectively.

Conclusion:

In conclusion, mastering the complexities of the real estate market necessitates a multifaceted approach encompassing detailed market studies, strategic financial planning, and innovative feasibility techniques. The expertise demonstrated by pioneers like ERA Egypt highlights the value of comprehensive market feasibility planning in achieving successful outcomes. Furthermore, understanding key indicators and integrating macro analysis into decision-making processes provide a solid foundation for navigating economic fluctuations and demographic shifts. As the industry evolves with advancements in technology and changing consumer preferences, staying abreast of future trends will be essential for sustained success. By adopting these insights and strategies, real estate investors and developers can position themselves for long-term growth and profitability in an ever-evolving landscape.